Disclosure: H&R Block has been a longtime supporter of The Cornerstone through their financial literacy initiatives. They have compensated me for helping them spread the word about these free resources for teachers and kids.

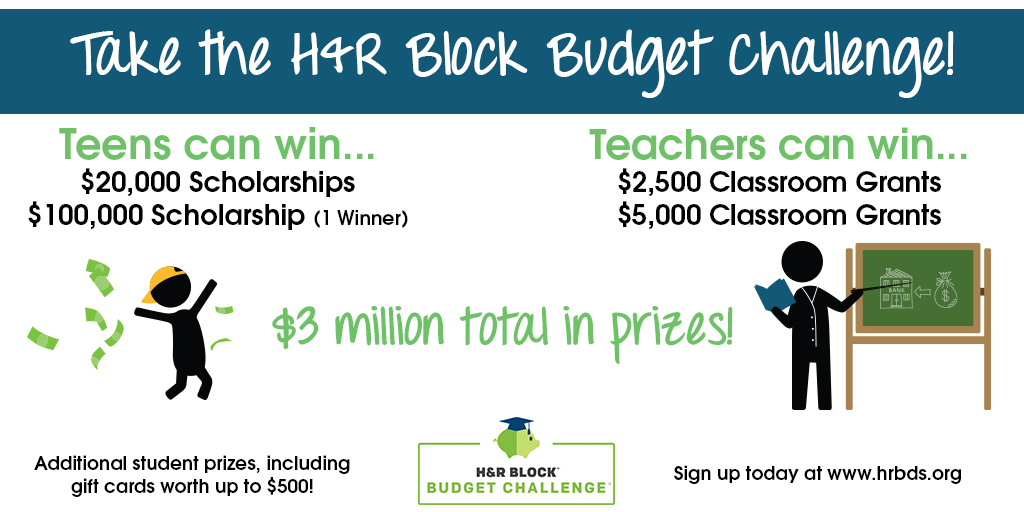

You might remember back in September when I shared information about the H&R Block Challenge, a completely FREE teen financial literacy program in the form of an online game. Though the game itself is a valuable experience for students as they learn money management skills and apply them in authentic contexts, students can also compete against students in other classes and schools to earn grants for their classroom and scholarships for themselves!

The average student score of each class enrolled is updated nightly from October through April of this school year. At the midway point and conclusion of the simulation, classes with the highest scores win a classroom grant. At the conclusion of each simulation period, the 22 students with the highest individual scores each win a $20,000 student scholarship. In April, the student with the highest overall score receives a $100,000 scholarship!

I think it’s amazing that kids are earning grants and scholarships while learning through game play, so I asked H&R Block to put me in touch with one of the teachers whose students have won. Meet Holly Johnson!

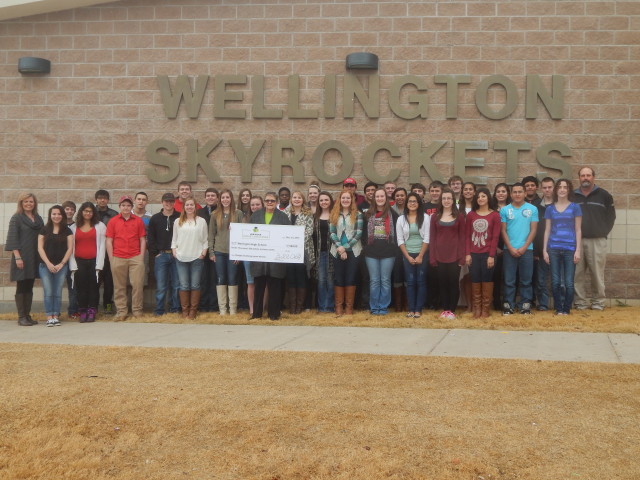

Holly has been teaching for 22 years (go Holly!) and currently teaches math and accounting at Wellington High School in Wellington, Texas. 38 students participated under her supervision, and they’ve won two grants totaling $7,500!

Holly shared that Wellington is a small town and most of the residents knew about the game. She said that many adults in the community told her they wished they could have participated in a program like this when they were in school! “Many parents have said positive things about the program. Our small town loved this simulation, and we are most thankful for the grant H&R Block gave to us.”

During game play, her students took on the role of a college graduate who had been in the workforce for almost a year. Holly said that all kinds of unexpected events occurred during the simulation, both negative (an automobile accident, theft, excessive Black Friday shopping with a credit card) and positive (a Christmas bonus, and a raise after one year of employment.) The simulation was definitely realistic and provided students with the chance to experience the effects of lots of typical life events.

So what did her students learn? “They learned that bankruptcy would not dismiss the responsibility of paying back student loans, and they learned which tax form to use so that student loan interest could be deducted from their income,” said Holly.

“The late fees and using the credit card for daily expenses were real eye openers for the students. They love their money and don’t like to part with it! Many times students don’t think rules apply to them. But, through deadlines and late fees, they quickly found out that the consequences meant less money in their pockets. The unexpected events that negatively affected their bank balance were great lessons as well. Their parents couldn’t pay for their stolen lap top or fender bender; they had to use their own money and face the consequences.”

Holly also felt that the quizzes were very educational. “As Texas residents, we don’t have a state income tax. It was beneficial for students to learn that other states do. I, personally, learned that some cities have city income taxes. Hopefully, students will carry this information with them when choosing their place of residence.”

The reality of saving for retirement is something that the H&R Block Budget Challenge really drove home for Holly’s students. “I feel that the Budget Challenge will make the students think twice about who they choose as their employer,” Holly said. “After seeing the added benefits of employer-matched 401K funds first-hand, I feel that they will take the time to research the companies with whom they will interview. The students now know how to use readily available compound interest calculators to think ahead to their retirements. All they need now is a lesson on inflation!”

An free online game to teach kids about budgeting and financial literacy: kids and teachers can win scholarship money and grants for playing!

I’m so proud of Holly’s hard work and that of her students. If you teach any grade from 9th through 12th, your students are most likely eligible to play, too!

Register here for your students to play the game: sign up is super quick and simple. As they start playing, your students’ scores will be automatically calculated and they’ll be entered to win the grants and scholarships. Good luck!

Angela Watson

Founder and Writer

Sign up to get new Truth for Teachers articles in your inbox

OR

Join our

community

of educators

If you are a teacher who is interested in contributing to the Truth for Teachers website, please click here for more information.